Services

Because we take to heart our role to work hand-to-hand with your teams over any markets related problematics and mission; sizeable companies already placed their trust and confidence in us.

See below a list of responsabilities handled by EQTrack.

Technology metals market (tm2)

a cutting-hedge exchange

TM2 has established itself as a global exchange marketplace and trading business that enables investors to trade a new asset class of high-value technology metals critical to global technology industries. The exchange is connecting the supply from 40 different metal verticals to a far wider demand around the world.

All the products on TM2 are physically backed 1:1 by the metals held in a custodian network.

Eqtrack role

By taking the lead on the whole market and trading department, EQTrack had a role at the forefront of TM2 development.

EQTrack position covered many aspects of the business summarized in the Missions section.

Algorithmic Trading agents

From the design

With the experience gained through the Algorithmic Trading Programme from the University of Oxford, Saïd Business School, EQTrack's funder is devoted in creating profitable electronic trading algorithms for all kind of risk-adversity and economically making sense.

Backtesting is not an end in itself and must not be used to calibrate a model, but should validate the rationality behind the strategy instead.

to the implementation

EQTrack offers different solutions for both individuals and profesionnals in the scope of trading algorithms.

Our code is usually written in Python and run 24/7 on remote servers hosted by PythonAnywhere. When cryptocurrencies are used as underlying, we flow our orders to FTX.

We offer 3 turnkey plans depending on your needs and goals.

Reach out to our team for more information.

Log in below to access your personal interface and track the performance of the various trading strategies.

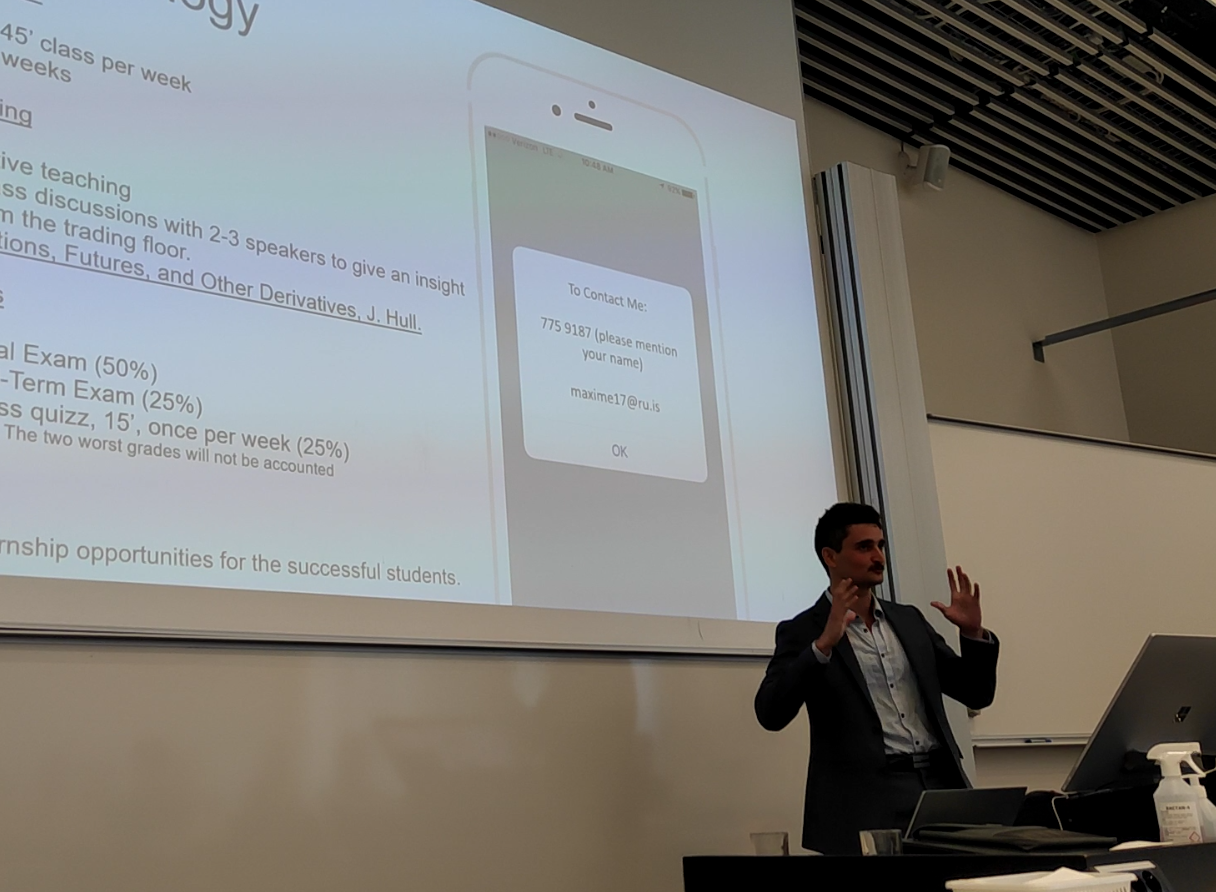

Seminar & Trainings

Eqtrack pledge

We run a careful assessment of the audience category in order to dedicate appropriately our time and energy to create unique content and personalized format adapted to the hearing it should be addressed.

During complementary sessions, we rely ourselves on external speakers to give deep insights on very specific matters, live from their trading floors. This is usually the "extra" that makes our audience loving these trainings.

We take pride in turning conferences, university teaching, seminars, .. into an experience.

Our topics are suitable both for students and professionals in a whole range of subjects listed in the Topics tab.

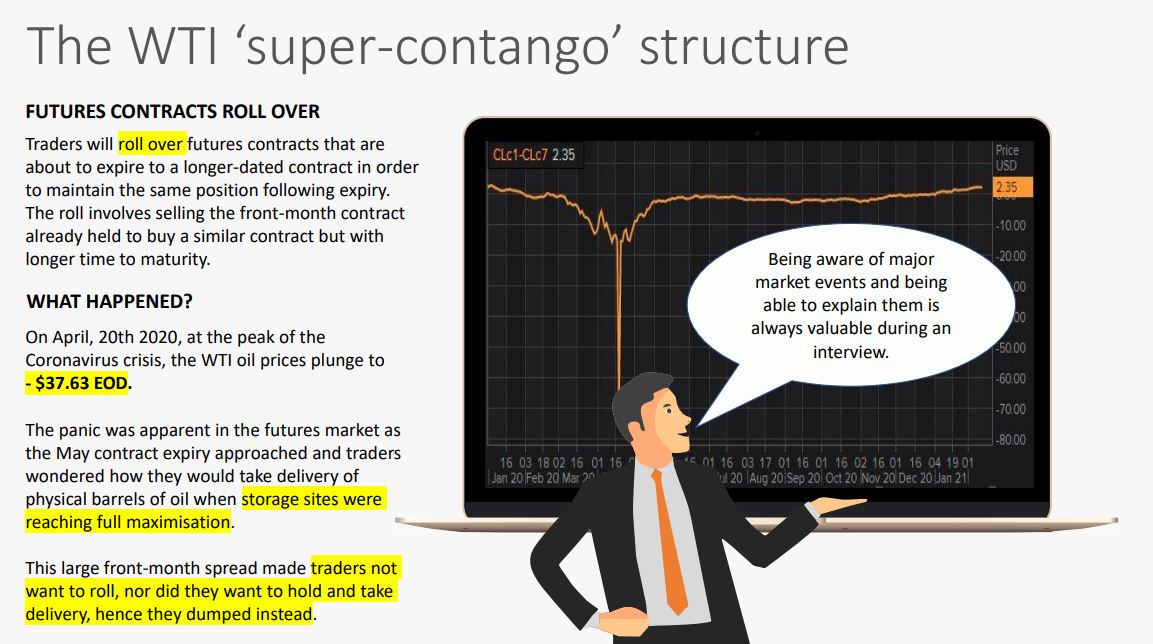

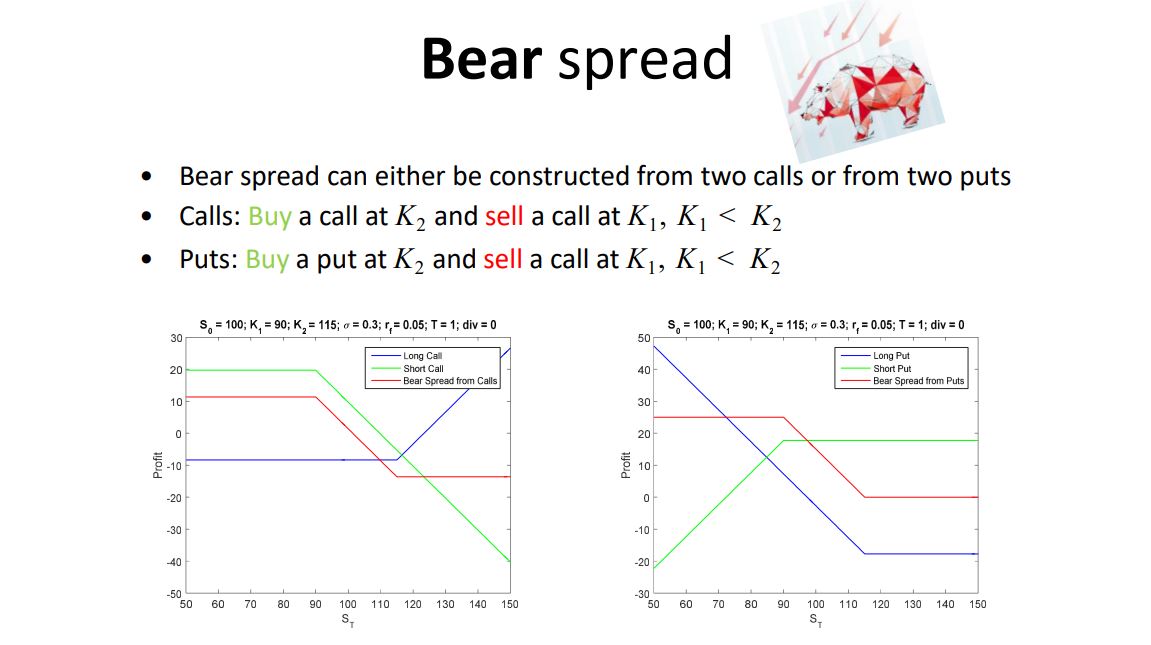

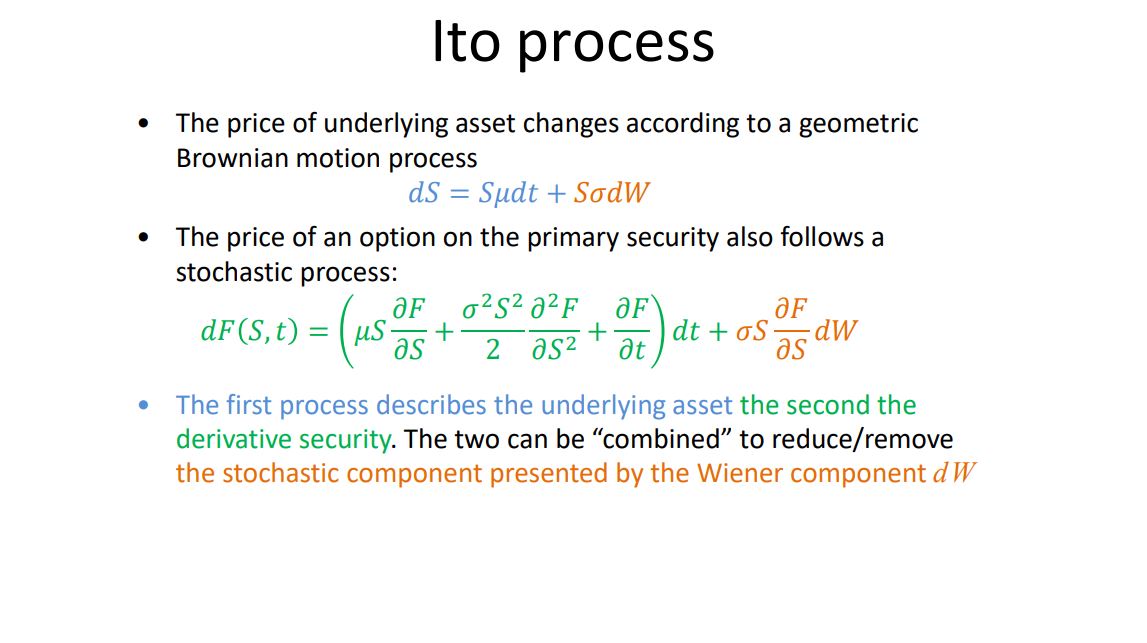

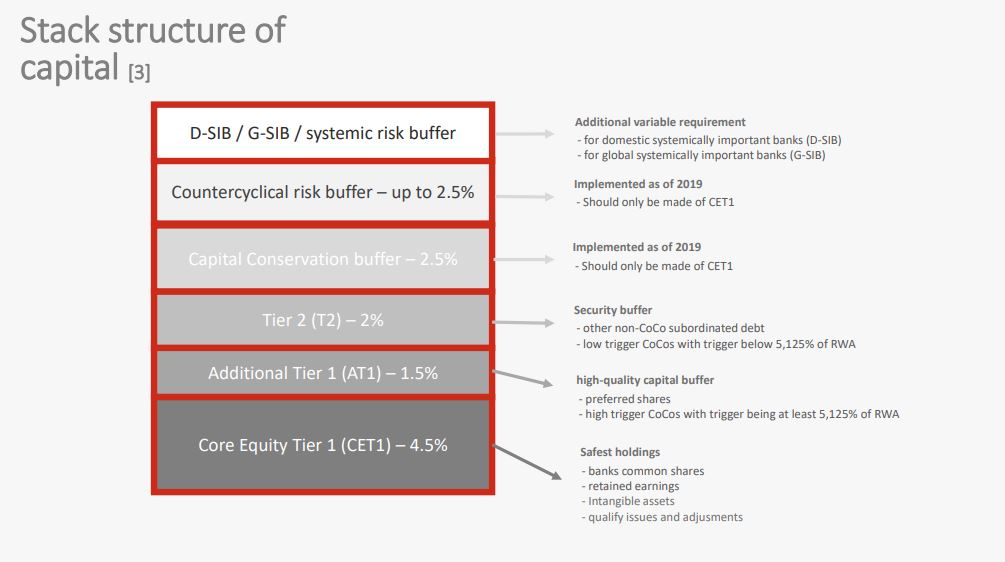

Financial markets

Business

samples

ad-hoc missions

Your front-line support

EQTrack is working on temporary missions for various clients and ready to handle more of these contracts.

We work with your existing team as a Trading, Sales or Quant support - ultimately, we contribute in reducing your operating expenses allocated to the field of trading, research and global market division.

We guarantee full confidentiality through NDA if required.

over endless possibilities

Feel free to navigate in the above panels to see examples of companies that trusted us for punctual missions. Other illustrastions are provided below.

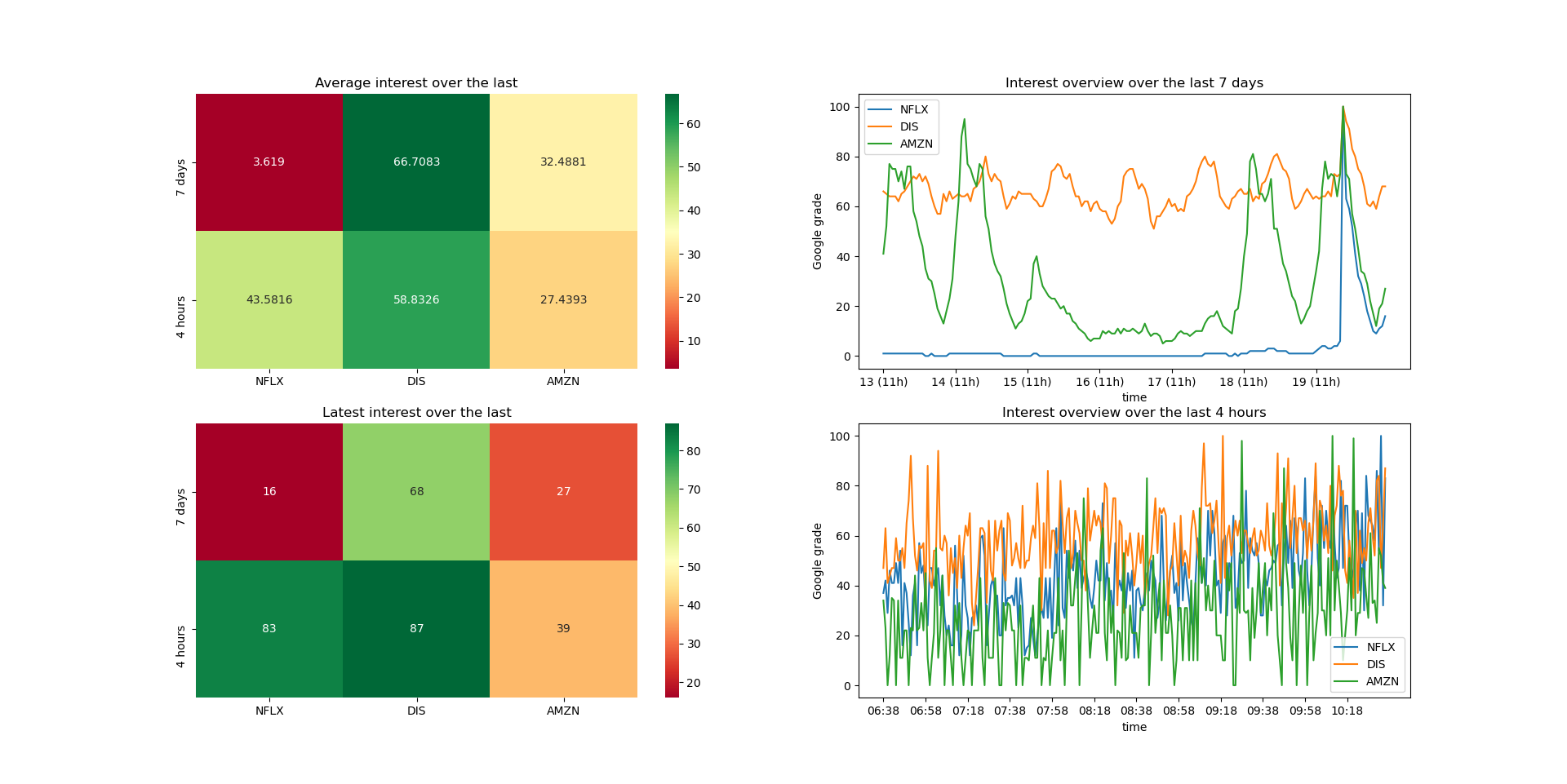

Live-time analysis of query trends on Google with Financial Market impact: Volumes, Share Price, Correlation between assets.

(Python, Google Trends, Yahoo Finance)

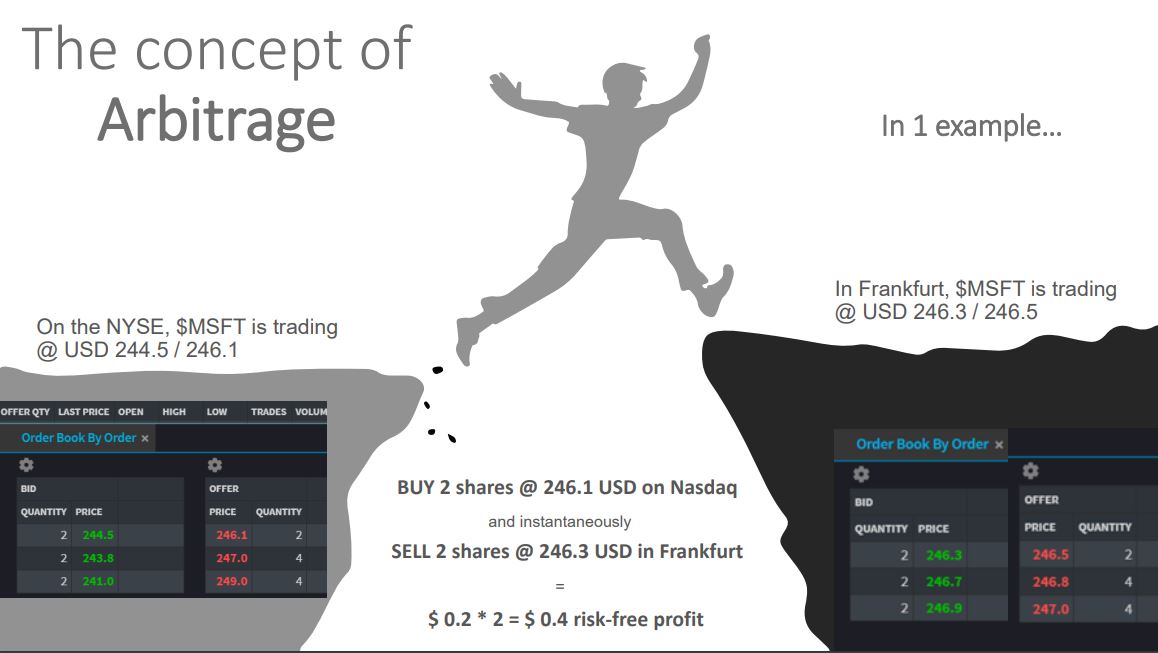

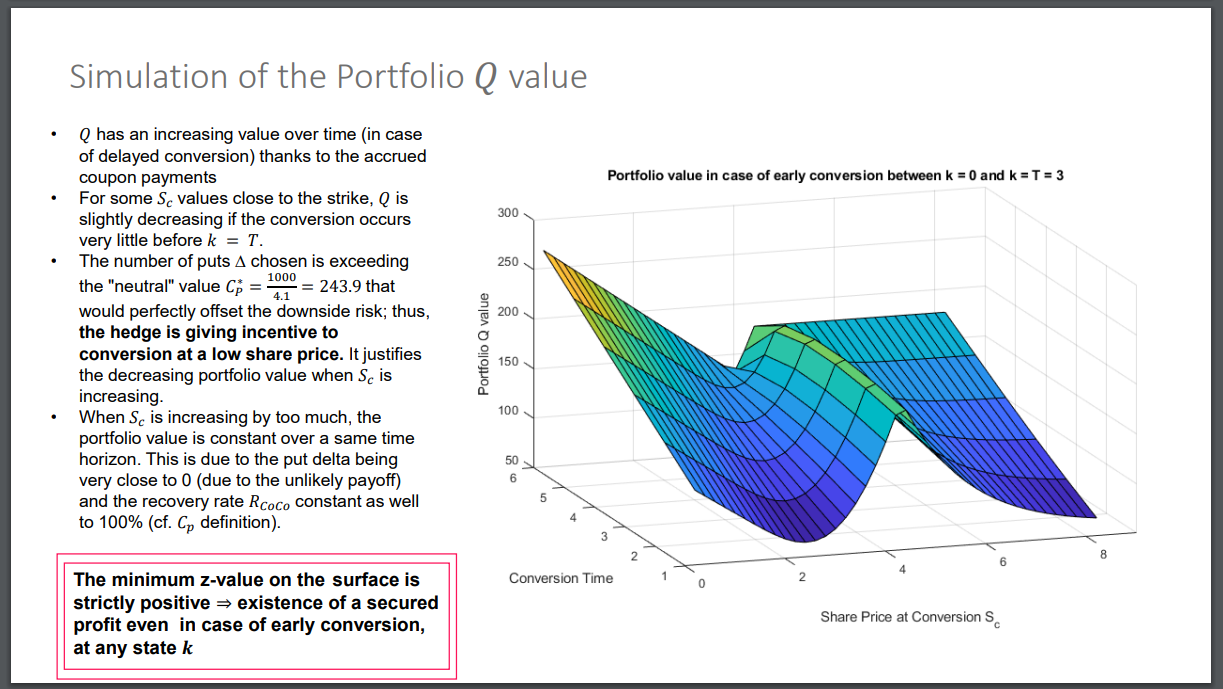

Portfolio value surface following hedging of a downside risk. The surface being strictly positive reveals the existence of an arbitrage opportunity from inception time.

Context

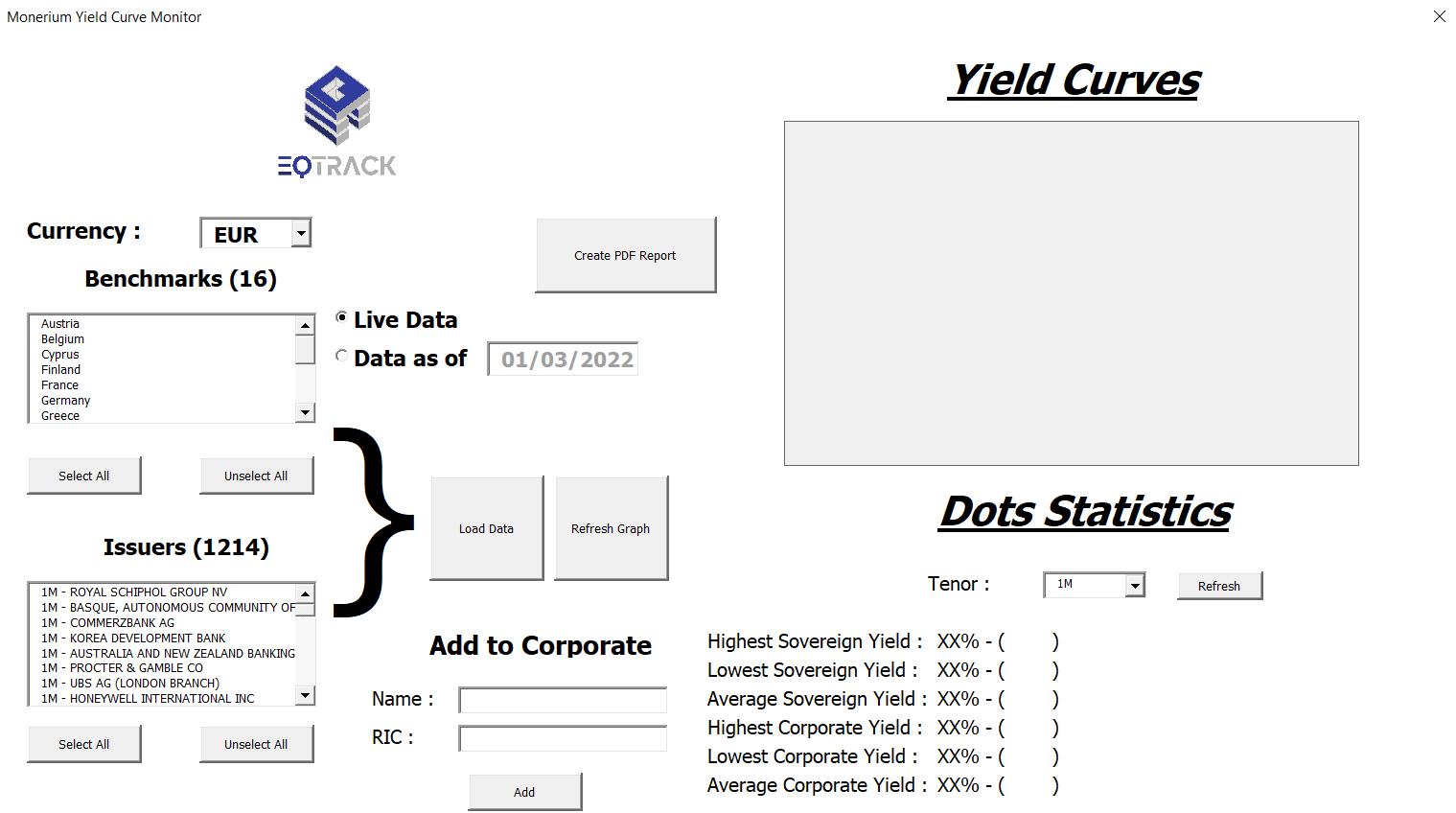

Monerium is a disruptive DeFi company involved in the issuance, transfer and settlement of e-money.

The FinTech is the first of its kind to be authorized by the financial regulator to issue money on blockchains. They also benefit from a European passporting allowing them to operate in all the EU member states, in addition to Iceland, Norway and the Lichtenstein.

More recently, they successfully raised $4 million to accelerate the development of the company.

EQTrack missions

In August 2019, EQTrack got punctually involved into investment analysis assignments.

Over the year 2021, EQTrack acted as the research building block for Capital Sniper and provided the below services: